WI A-772 2018-2025 free printable template

Show details

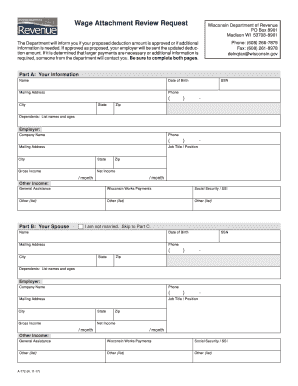

Average Attachment Review RequestPrintClearWisconsin Department of Revenue

PO Box 8901

Madison WI 537088901The Department will inform you if your proposed deduction amount is approved or if additional

information

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign wisconsin 772 attachment request make form

Edit your wisconsin 772 review request form fill form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your wisconsin a 772 wage pdf form via URL. You can also download, print, or export forms to your preferred cloud storage service.

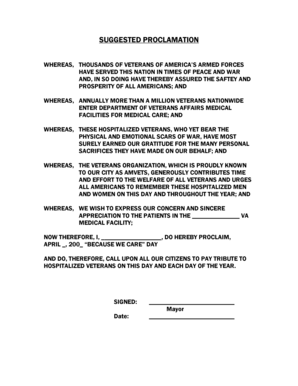

Editing wisconsin attachment request form print online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit wisconsin a772 wage fillable form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

WI A-772 Form Versions

Version

Form Popularity

Fillable & printabley

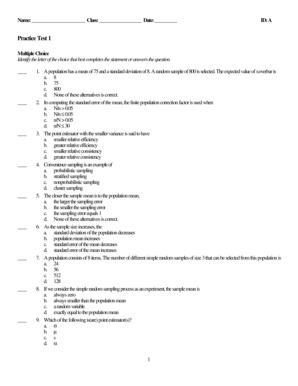

How to fill out wi a 772 request form download

How to fill out WI A-772

01

Obtain the WI A-772 form from the relevant state department website or office.

02

Fill out the applicant's personal information including name, address, and contact details.

03

Provide any required identification numbers, such as Social Security number or taxpayer ID.

04

Complete sections related to the purpose of the application, ensuring to provide accurate and detailed information.

05

Review the application for completeness and accuracy.

06

Sign and date the application as required.

07

Submit the completed form either electronically or via mail to the designated authority.

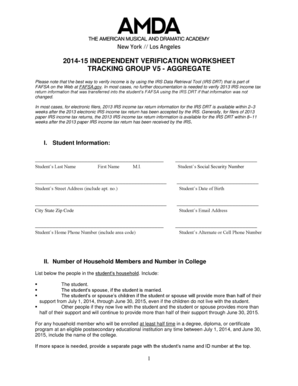

Who needs WI A-772?

01

Individuals applying for certain state benefits or services in Wisconsin.

02

Organizations that assist individuals in completing state-required applications.

03

Legal representatives filing on behalf of clients who need state assistance.

Fill

wisconsin a772 wage attachment request form

: Try Risk Free

People Also Ask about wisconsin a772 attachment review form download

What is the Wisconsin tax deduction form?

Form WT‑4 will be used by your employer to determine the amount of Wisconsin income tax to be withheld from your paychecks.

What is the wage attachment for Dor in Wisconsin?

We issue a wage attachment for 25% of gross earnings per pay period. The employee has an existing wage garnishment of $250.

What is the payroll tax in Wisconsin?

If you're a new employer, you will pay 3.05% if your payroll is less than $500,000 and 3.25% if your payroll is above $500,000. If you're a new employer in the construction industry, you'll pay 2.90% if your payroll is less than $500,000, and 3.10% if your payroll is above $500,000.

What is the exemption for wage garnishment in Wisconsin?

By law, you are entitled to an exemption of not less than 80% of your disposable earnings. Your "disposable earnings" are those remaining after social security and federal and state income taxes are withheld.

What does it mean to have wages attached?

A wage attachment, also called a wage garnishment, is the process of deducting money from an employee's pay as the result of a court order or action by an authorized agency. Common examples of debt that result in attachments include: Child support. Unpaid taxes. Unpaid court fines.

How much can they garnish your wages in Wisconsin?

Limits on Wage Garnishment in Wisconsin. Under Wisconsin law, most creditors can garnish the lesser of (subject to some exceptions—more below): 20% of your disposable earnings, or. the amount by which your disposable earnings exceed 30 times the federal minimum wage.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send wisconsin a 772 review request download to be eSigned by others?

Once you are ready to share your wisconsin attachment review form get, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I edit wisconsin a wage attachment request search online?

With pdfFiller, the editing process is straightforward. Open your wisconsin a attachment request form print in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I edit wisconsin a review form sample on an Android device?

The pdfFiller app for Android allows you to edit PDF files like wisconsin review form template. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is WI A-772?

WI A-772 is a form used by businesses in Wisconsin to report specific tax information to the state.

Who is required to file WI A-772?

Businesses that meet certain criteria regarding their revenue and tax obligations in Wisconsin are required to file WI A-772.

How to fill out WI A-772?

To fill out WI A-772, you need to provide accurate information regarding your business's revenue, expenses, and tax liabilities as specified in the form instructions.

What is the purpose of WI A-772?

The purpose of WI A-772 is to ensure that businesses report their taxable income accurately to the state and comply with Wisconsin tax laws.

What information must be reported on WI A-772?

Information that must be reported includes business identification details, revenue figures, deductions, and any other relevant financial data as required by the form.

Fill out your WI A-772 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Wisconsin A 772 Review Request Printable is not the form you're looking for?Search for another form here.

Keywords relevant to wisconsin a 772 request online

Related to wisconsin a 772 template

If you believe that this page should be taken down, please follow our DMCA take down process

here

.